General information about rent

![]()

The rent that you pay for your home covers the cost of building, maintaining, repairing and improving the properties we own, as well as funding the management of the properties and the Group itself.

How are rents calculated?

We would like to explain a little more about how rents are calculated, and what has been happening with rents in the social housing sector in the last few years.

As a registered provider of social housing we can’t choose to charge what we like. The formula for calculating rents is set by the Government, and they tell us what we can charge.

Up to 2014/15, rents have increased every year with increases in charges usually being calculated using the Consumer Price Index (CPI) or the Retail Price Index (RPI) which are common measures of inflation in the UK.

In 2013 the Government announced that in each of the following ten years, we could increase rents by CPI plus 1%. Then in 2015, for the first time ever, the Government made a surprise announcement that we must apply a 1% decrease in each of the following four years instead.

As an example, the table below shows the impact of these calculation changes, starting with rent of £100 per week in 2015/16 and applying actual CPI rates:

| Year | Rent per week (Increase each year CPI + 1%) | Rent per week (1% decrease each year until 2020/21, then CPI + 1%) |

| 2015/16 | £100.00 | £100.00 |

| 2016/17 | £100.90 | £99.00 |

| 2017/18 | £102.92 | £98.01 |

| 2018/19 | £107.04 | £97.03 |

| 2019/20 | £110.68 | £96.06 |

| 2020/21 | £113.67 | £98.65 |

What will happen in April 2020?

The Government have told us that we can start to increase rents again from April this year. We can increase rents by the rate of CPI in September 2019, plus 1%. September CPI rate was 1.7%, meaning that our proposed rent increase from April will be 2.7%.

This rent increase will provide more money to allow us to deliver more services, more improvements and build more homes.

The impact of rent changes since 2016

The Government sets standards for how we provide services to our tenants. One of many tests they use to ensure we are doing things responsibly is to check each year, that we will have the resources to do everything properly for the next 30 years.

Our financial plan must demonstrate that we have sufficient resources to meet the cost of all repairs, all elements of planned improvements like new bathrooms, roofs and kitchens etc. for the next 30 years. We also need to demonstrate that we have money to build new homes for tenants too.

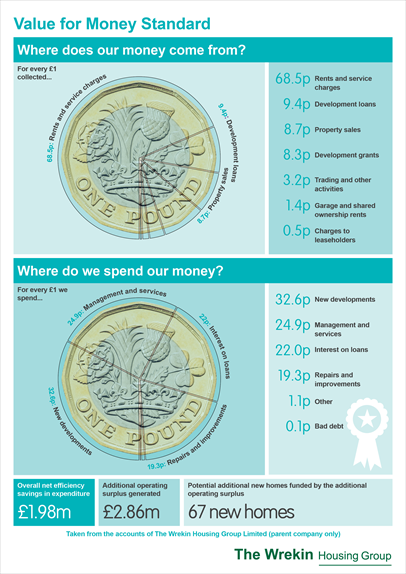

The graphic shown illustrates a breakdown of how every £1 received in 2018/2019 we spent:

There is a lot of focus placed on ensuring that all of our properties are safe. Ensuring high standards of health and safety compliance brings new costs too, such as the installation of new fire doors.

We also have to buy goods and specialist services enabling us to provide services to you. The price of materials, equipment and contractors charges have continued to increase with inflation even though we have less money available. Like all housing associations, we have had to make less money stretch further than we have had to before.

Despite all of the above, most of the tenants that we ask agree that they would recommend us to their family or friends. We also know that our tenants value the ‘home for life’ we provide rather than a short six month tenancy, and that our rents are considerably lower than average rents in the private sector around us.